From Wall Street to Fintech: How AI Is Changing the Game in Finance

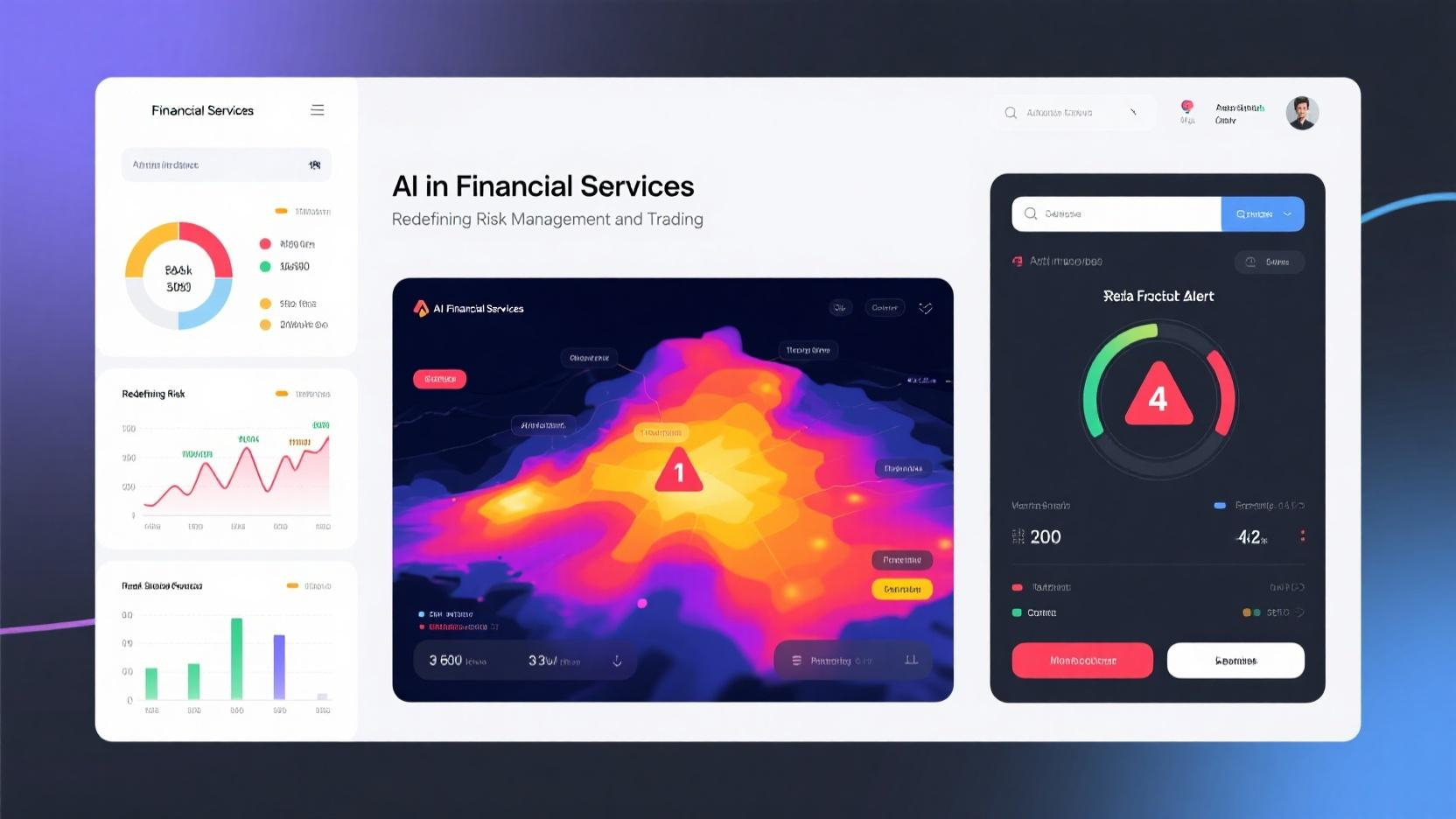

Artificial intelligence is reshaping the financial services industry, from automated trading floors to real-time fraud detection. As markets grow more complex and volatile, financial institutions are deploying AI to enhance precision, reduce risk, and uncover new opportunities in investment and risk management.

AI in Risk Management — From Reactive to Predictive

Traditionally, risk management has relied on historical models and human judgment. AI now enables:

Real-time analysis of market, credit, and operational risks

Dynamic risk scoring using machine learning algorithms

Early warning systems that detect anomalies or stress signals

For instance, JP Morgan Chase uses AI to monitor thousands of transactions per second, flagging potential fraud or credit exposure before it escalates. These systems reduce losses and regulatory penalties while improving decision speed.

AI-Powered Trading — Speed and Strategy

In trading, AI offers a decisive edge:

Algorithmic trading bots analyze market signals at lightning speed

Sentiment analysis from news and social media impacts decision models

Reinforcement learning agents adapt strategies based on market feedback

Hedge funds like Renaissance Technologies and Two Sigma use AI-driven models to gain alpha, while Robinhood and other platforms use it to optimize retail trading UX and offer robo-advice.

Fraud Detection and Compliance

Financial fraud is constantly evolving, and AI helps institutions stay one step ahead:

AI models detect unusual transaction patterns in real time

Natural Language Processing (NLP) helps scan regulatory documents and detect compliance risks

Identity verification systems using biometrics and facial recognition reduce account fraud

For example, HSBC has implemented AI systems that scan billions of dollars in transactions for signs of money laundering, significantly improving its AML (Anti-Money Laundering) compliance posture.

Challenges and Ethical Considerations

Despite its promise, AI in finance faces:

Regulatory scrutiny over black-box algorithms

Bias in data leading to unfair lending or investment decisions

Data security concerns, especially in customer profiling

To address these, regulators and institutions are pushing for explainable AI (XAI) models and enhanced AI governance frameworks.

Key Takeaway

AI is not just optimizing finance—it’s redefining it. From risk modeling to intelligent trading, the integration of AI enables financial institutions to operate faster, smarter, and more securely, unlocking a new era of responsive and data-driven finance.